Do you Suffer from Anchoring?

What is Anchoring?

Anchoring bias can have a significant impact on our financial decisions. For example, when we're saving money, we may set an initial savings goal that's too low. This initial goal can serve as an anchor, making it difficult to increase our savings goals later on as it will mean altering our monthly budget. Similarly, when we're investing, we may be influenced by the values of portfolios, not wanting to go under a magic number (as this is perceived to be lower or less). This initial value can serve as an anchor, making it difficult to spend money even if it's right for us to do so.

Imagine you're shopping for a new car. You look online, find the one you want and it costs £20,000. You decide to head down to a show room and see the one you want, but it’s on sale for £18,997. You might think that's a great deal because you're comparing it to the original price. However, if you'd never seen the car before and it was just just priced at £18,997, you might not think it's such a good deal.

This is an example of anchoring bias. It's when we rely too much on the first piece of information we see, even if it's not relevant. In this case, the original price of £20,000 is the anchor, and it's influencing your perception of the sale price.

Anchoring and round number bias

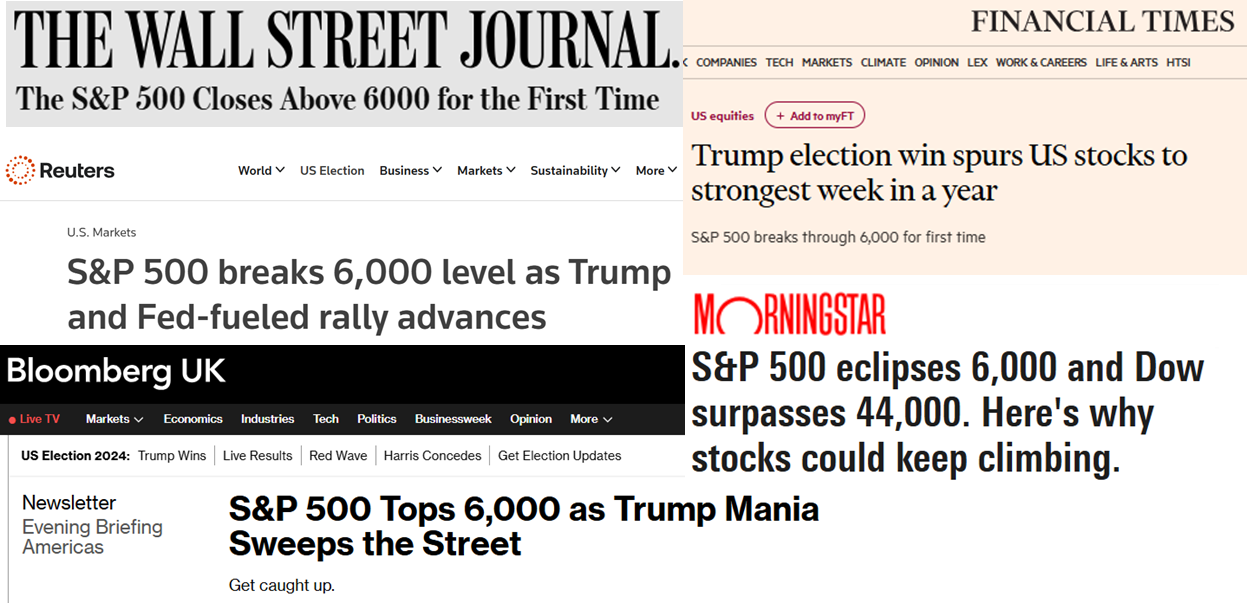

Source: WSJ/FT/Bloomberg/Reuters/Morningstar

If you’re a financial headline collector, you’ve been spoilt this past month, with wonderful examples of the Numberwang* nature of financial markets.

Absolute textbook. Frame them all; hang ‘em in the Louvre.

If he’s done nothing else, Donald Trump has managed to time his re-election perfectly, aligning it to a big, round number.

Why should 6,000 matter any more than 5,998 or 6,007?

Economically, it doesn’t – there’s no law saying that something does or doesn’t happen to the S&P 500 at 6,000.

But psychologically we absolutely LOVE round numbers. They stick in our brains. 6000 just feels nicer than 6,007 – right?

Think about the stock indices you look at. FTSE 100, S&P 500, EuroStoxx 50, Russell 2000. Maybe there’s an untapped market niche of stock benchmarks that are, like, prime numbers. The Prime UK 107 Index, or the Prime US Large Cap 503. Psychology would suggest not…

For the runners…

Source: Eric J. Allen, Patricia M. Dechow, Devin G. Pope, George Wu (2017) Reference-Dependent Preferences: Evidence from Marathon Runners. Management Science 63(6):1657-1672

One of our favourite examples is in marathon finishing times (from nearly 10 million individual runners; that’s good stats!). In the “amateur runner” range** typically, people try to get under a specific number.

And so, you see MASSIVE clustering before each round number hour cut-off (more people finishing than expected, diving over the line) and then a sharp drop off in the few minutes afterwards.

Once you recognise this tendency, you’ll see it everywhere: whether it’s record sales, Premier League goals scored or Insta followers. People will often run competitions when they hit the 1,000, 10,000 or 100,000 milestones!

Back to Financial Planning…

We often anchor our financial goals to specific round figures, like £100,000 or £500,000. While it's natural to feel pleased when our portfolio surpasses these milestones, we may become uneasy if it dips below. This emotional reaction, influenced by anchoring bias, can cloud our judgement, especially when we spend money or market fluctuations occur. The purpose of working with your financial planner is encouraging you to get the right balance between saving and spending that you are comfortable with. There is no rationale that suggests not spending money will lead you to live a better life (as far as we are aware), there is no point in being the richest person in the graveyard!

To counter anchoring bias, we encourage you to adopt a long-term perspective. Focus on your overall financial goals rather than short-term market fluctuations. Diversification can help smooth out volatility, and regular rebalancing can ensure your portfolio aligns with your risk tolerance and time horizon.

Additionally, consider consulting with your financial planner. They can provide objective advice and help you develop a robust financial plan that's tailored to your unique circumstances. By working together, we can navigate market uncertainties and make informed decisions that support your long-term financial well-being.

missed our latest blog posts, catch up here

Sources: 7IM - ‘7@7’

*Not seen Numberwang: https://www.youtube.com/watch?v=0obMRztklqU

** ”Amateur runner” is from just below 3 hours up to about 5 hours (don’t @me) – before and after that, people are actually just trying their hardest.